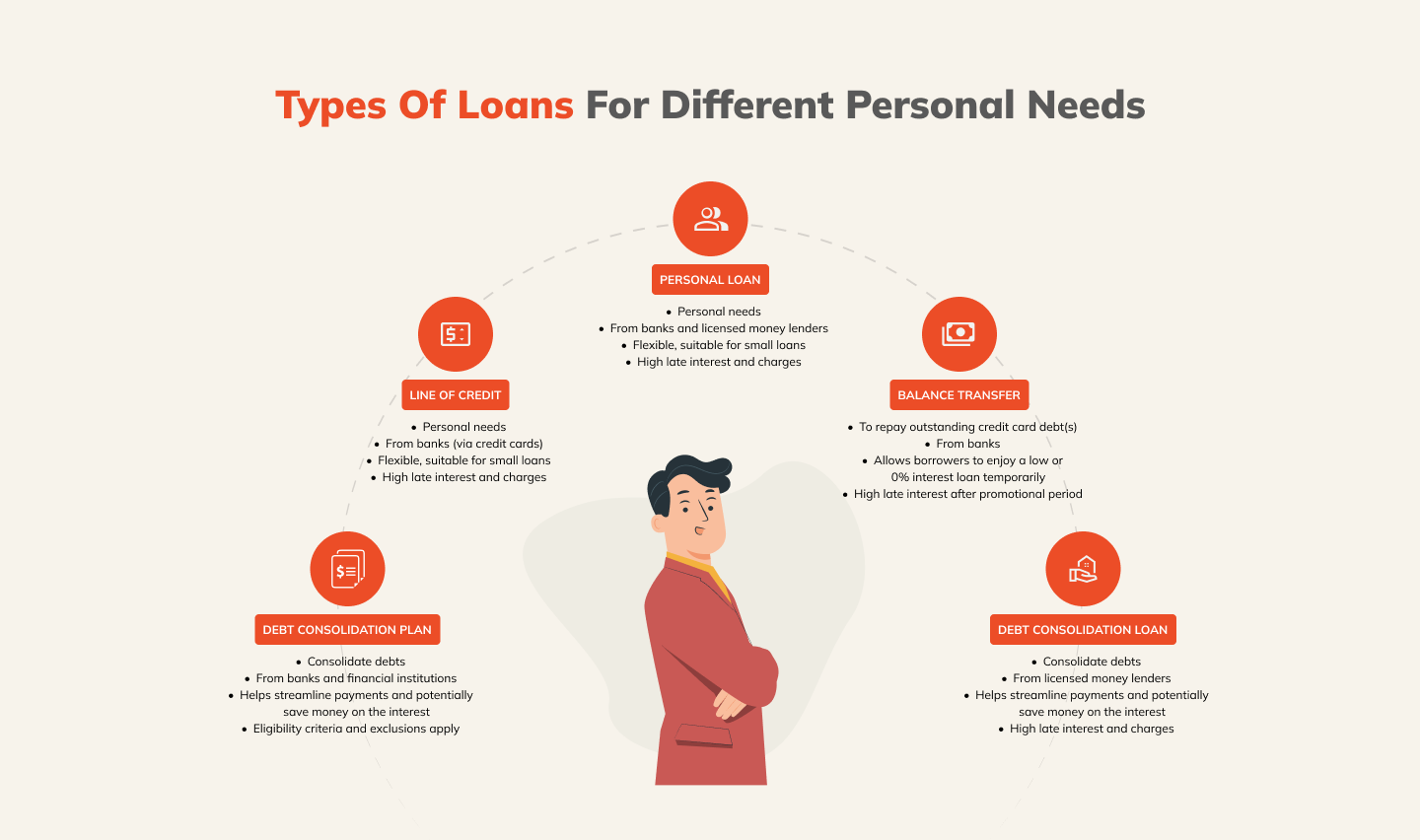

A personal loan is one of the more popular unsecured loans and it can be used for a wide range of personal needs, from medical emergencies, family expenses, instant cash, and even for a dream wedding. Personal loans can be issued by banks or licensed money lenders without any restrictions on how the loan can be used.

However, there are also other alternative loans that individuals can apply for, depending on their needs. Although all of these options provide access to a certain amount of funds, how the funds are specifically used can vary depending on the present scenario.

1. Personal Loan

Personal loans are typically instalment loans that you can obtain from a bank or licensed money lender. You borrow a sum of money from the loan provider, and repay the loan with an interest over a fixed number of months, as agreed in the repayment contract. These are usually short-term personal loans and can greatly help borrowers when they are struggling with urgent cash flow problems.

While banks are more reputable, personal loans from money lenders can sometimes be better for smaller loans due to flexible eligibility requirements, higher approval rates, and faster processing times. As long as you borrow from a legal money lender in Singapore, you can still be assured of a professional, secure service.

Learn more about licensed money lenders’ interest rates and loan tenures of personal loans here and the different reasons to get a personal loan.

2. Line of Credit

If you are familiar with the concept of credit cards, that is what a line of credit is. Sometimes called a revolving loan or cash line, a credit line allows you to borrow a set amount of money up to your credit limit.

However, the money won’t be counted as ‘borrowed’ until you withdraw it to spend on something. At the end of the month, you will need to repay the amount you spent, along with interest charges that accumulate daily.

If you default on this payment, the debt will roll over to the subsequent month, and you will have to pay more in the form of interest. A line of credit is good for covering small expenditures in times of unpredictable cash flow but isn’t so practical if you need to borrow a large sum of money all at once.

3. Balance Transfer

If you have outstanding credit card debt(s), you may need a balance transfer. Performing a balance transfer allows you to replace a high-interest debt with a lower-interest one. Essentially, this transfers your debt to another loan provider, which gives you a low- or zero-interest debt for a fixed period (e.g. 12 months). Banks usually offer promotional periods ranging from 3-12 months.

The catch is, you have to repay your balance transfer loan within the low- or zero-interest window, otherwise, you’ll be charged with interest rates that can go as high as 26.9% p.a. for the remaining debt that you owe. Thus, being very disciplined with your repayment plan and repaying your loans early or on time is key to taking full advantage of this type of loan.

Check out our tips on how you can save money and repay all your loans at the same time.

4. Debt Consolidation Plan

A debt consolidation plan is a debt refinancing program that combines multiple unsecured credit facilities and some types of unsecured loans into a single loan, usually with a lower interest rate and a longer repayment period. This can streamline payments and potentially save money on interest.

In Singapore, debt consolidation plans are offered only by participating financial institutions and banks.

To qualify for a debt consolidation plan in Singapore, you must have outstanding debts that exceed 12 months of your monthly income. You also need a minimum income of $20,000 per year and must not have any outstanding bankruptcy or legal actions against you.

Take note that certain types of unsecured loans are excluded from the debt consolidation plan — joint accounts, renovations loans, education loans, medical loans, and credit facilities granted for businesses or business purposes.

While debt consolidation plans can help manage multiple debts, they are not a one-size-fits-all solution. You must carefully consider the terms and fees associated with a debt consolidation plan before deciding whether it’s the right option.

5. Debt Consolidation Loan

While licensed money lenders in Singapore do not offer debt consolidation plans, they do provide debt consolidation loans. Similar to a debt consolidation plan, a debt consolidation loan merges your debts from multiple lenders into one debt.

Although you still have to pay interest on this consolidation loan, it is typically lower. An additional advantage lies in the convenience of repaying your debts, as you now have to pay to only one lender, instead of multiple ones.

Debt consolidation loans are typically reserved for those who have a large amount of debt. Thus, the repayment period is usually quite a lengthy one, as compared to a balance transfer or personal loan.

Unlike debt consolidation plans, there is less restriction on the type of loans you can consolidate using debt consolidation loans. In addition, licensed money lenders have lower eligibility criteria, no minimum income requirements, and they do not practice credit discrimination.

Here are some things you need to consider before taking a debt consolidation loan.

Do you need a personal loan?

Goldstar Credit is a licensed money lender providing affordable personal loans. Our simple interest rates start from 2.27% monthly, with a repayment period of up to 12 months.

Find out more about our personal loans here.

About the Author

Instituted since 2009, Goldstar Credit is a proficient licensed lender through and through. We pride ourselves on sharing our extensive personal finance expertise and knowledge with anyone and everyone who is keen on learning more about them.